Global Credit Risk Assessment Software Market Size, Growth Analysis and Forecast Insights

Report ID : 1398306 | Published : July 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Credit Risk Assessment Software Market is categorized based on Deployment Model (On-Premise, Cloud-Based) and Application (Credit Scoring, Portfolio Management, Regulatory Compliance, Fraud Detection, Risk Monitoring) and End-User (Banks, Insurance Companies, Investment Firms, Retailers, Fintech Companies) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

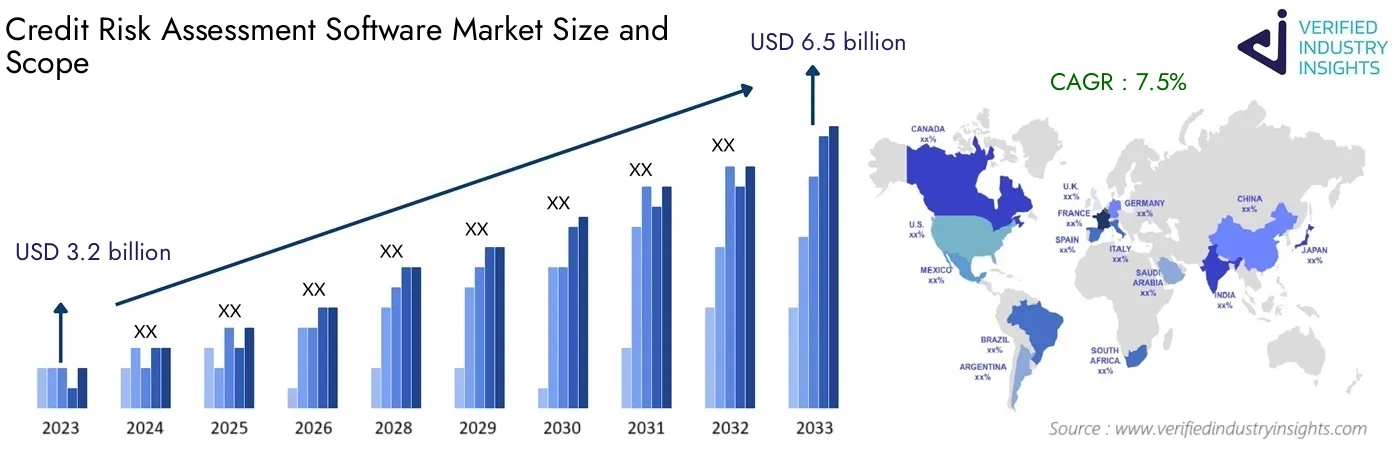

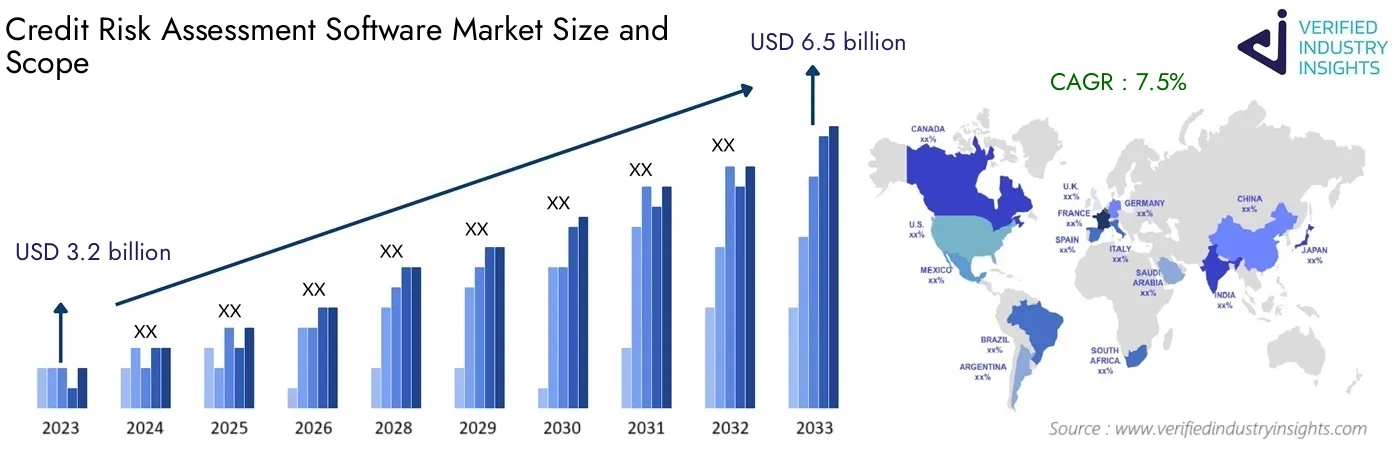

The Credit Risk Assessment Software Market size was valued at USD 3.2 billion in 2023 and is projected to reach USD 6.5 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033. This report includes various market segments and analyzes the key trends and factors influencing market growth.

The Credit Risk Assessment Software is now marking its place on the market's growth as the companies are realising the significance of evaluating and managing credit risk effectively. Economic volatility and regulatory pressure have compelled companies to adopt advanced software products that can enhance credit evaluation. Such tools not only assist in the evaluation of possible borrowers but also aid understanding of an organization’s lending policy and objectives. So, the competition in the market of credit risk assessment software is growing due to the growing need to keep up with constantly changing technological standards throughout risk management.

For businesses and financial institutions, the advanced tools are allowing to take a step forward. Integrating artificial intelligence and machine learning into credit assessment software has allowed businesses to transform the way creditworthiness is evaluated. Such technologies transform how organizations assess a credit risk by allowing them to sift through large pools of data more efficiently. This advancement not only streamlines the decision-making process but also promotes transparency and accountability in lending decisions. Growth of such tools will facilitate market maturity but as that happens new trends will begin to emerge which would require stakeholders to stay proactive for an competitive edge.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | FICO, SAS Institute, Moody's Analytics, Experian, Oracle, SAP, CreditRiskMonitor, Zoot Enterprises, RiskSpan, Dun & Bradstreet, TransUnion |

| SEGMENTS COVERED |

By Deployment Model - On-Premise, Cloud-Based

By Application - Credit Scoring, Portfolio Management, Regulatory Compliance, Fraud Detection, Risk Monitoring

By End-User - Banks, Insurance Companies, Investment Firms, Retailers, Fintech Companies

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Credit Risk Assessment Software Market Dynamics

The Credit Risk Assessment Software Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Credit Risk Assessment Software Market Segmentations

Market Breakup by Deployment Model

- Overview

- On-Premise

- Cloud-Based

Market Breakup by Application

- Overview

- Credit Scoring

- Portfolio Management

- Regulatory Compliance

- Fraud Detection

- Risk Monitoring

Market Breakup by End-User

- Overview

- Banks

- Insurance Companies

- Investment Firms

- Retailers

- Fintech Companies

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Credit Risk Assessment Software Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- FICO

- SAS Institute

- Moody's Analytics

- Experian

- Oracle

- SAP

- CreditRiskMonitor

- Zoot Enterprises

- RiskSpan

- Dun & Bradstreet

- TransUnion

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved