Digital Credit Risk Management Industry Global Overview: Market Size, Growth Insights and Forecast

Report ID : 1399724 | Published : July 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Digital Credit Risk Management Industry is categorized based on Solution Type (Credit Risk Assessment, Credit Scoring, Portfolio Management, Fraud Detection, Regulatory Compliance) and Deployment Type (On-Premises, Cloud-Based) and End-User (Banks, Insurance Companies, Investment Firms, Retailers, FinTech Companies) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

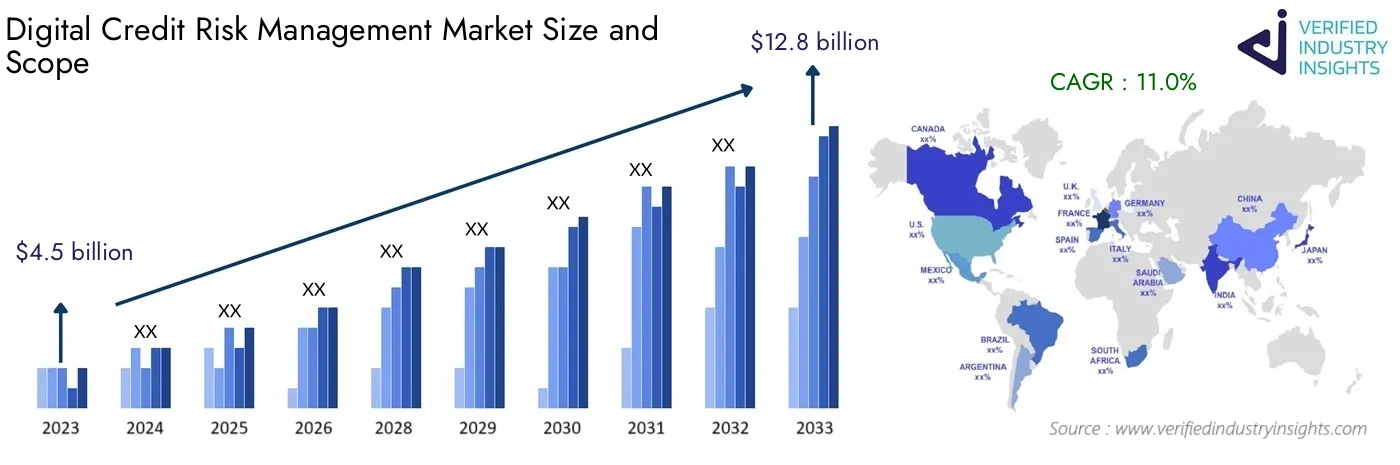

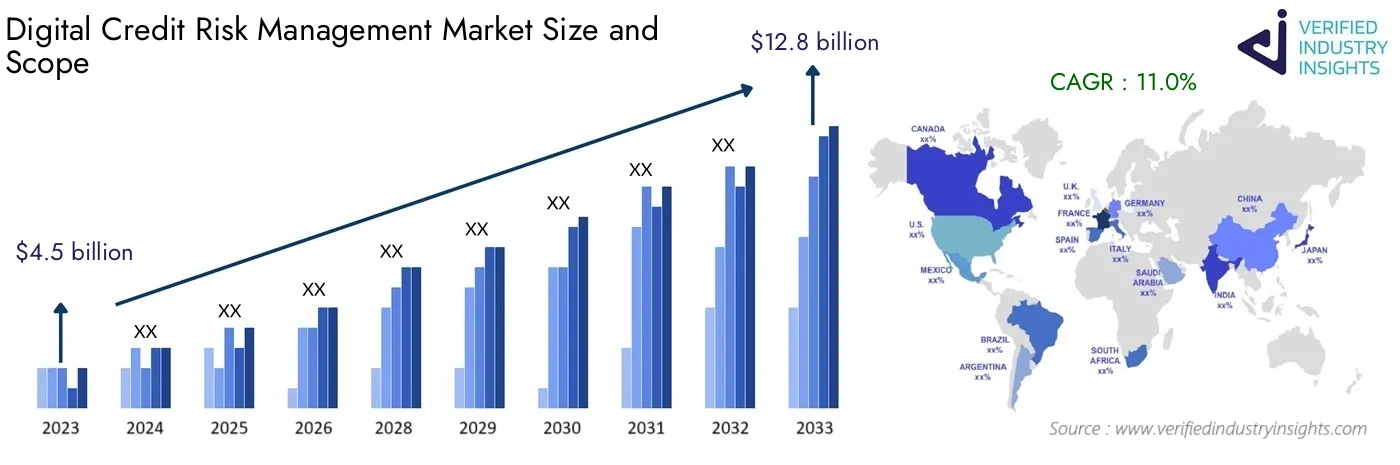

The Digital Credit Risk Management Industry, valued at $4.5 billion in 2023, is anticipated to expand to $12.8 billion by 2033 at a CAGR of 11.0% from 2024 to 2033. This report covers different segments and offers an analysis of the substantial trends and factors affecting the market.

The Digital Credit Risk Management Market is shifting rapidly as firms try to grapple with the challenges that come with evaluating credit risk in a digital environment. As businesses increasingly depend on financial dealings with technology, there is a growing recognition of the need for appropriate technology structures that aid in decision-making while also providing a safeguard against defaults and financial losses. This market includes all the tools and methods that evaluate the creditworthiness of customers, manage the risk-acceptance approval workflow, and maximize the balance between favorable underwriting and minimization of risk exposure, thus becoming essential for organizations that aim to succeed in a highly competitive world.

With financial institutions and businesses undergoing digital transformations, there is a notable increase in the need for sophisticated credit risk management solutions. Using data analytics, artificial intelligence, and machine learning makes it easy to monitor credit risk in near real-time thereby allowing organizations to make appropriate lending decisions. Also, the use of digital platforms enhances the efficiency and transparencyof the credit assessment process which enables these firms to respond more rapidly to the volatile market conditions as well as changing customer demand. In this regard, determining the tendencies and what propels change in the Digital Credit Risk Management Market is essential if such organizations intend to gain a competitive advantage and ensure growth.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | FICO, Experian, Equifax, SAS Institute, TransUnion, Moody's Analytics, Credit Karma, ZestFinance, Riskalyze, Oracle, BlackRock |

| SEGMENTS COVERED |

By Solution Type - Credit Risk Assessment, Credit Scoring, Portfolio Management, Fraud Detection, Regulatory Compliance

By Deployment Type - On-Premises, Cloud-Based

By End-User - Banks, Insurance Companies, Investment Firms, Retailers, FinTech Companies

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Digital Credit Risk Management Industry Dynamics

The Digital Credit Risk Management Industry is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Digital Credit Risk Management Industry Segmentations

Market Breakup by Solution Type

- Overview

- Credit Risk Assessment

- Credit Scoring

- Portfolio Management

- Fraud Detection

- Regulatory Compliance

Market Breakup by Deployment Type

- Overview

- On-Premises

- Cloud-Based

Market Breakup by End-User

- Overview

- Banks

- Insurance Companies

- Investment Firms

- Retailers

- FinTech Companies

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Digital Credit Risk Management Industry

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- FICO

- Experian

- Equifax

- SAS Institute

- TransUnion

- Moody's Analytics

- Credit Karma

- ZestFinance

- Riskalyze

- Oracle

- BlackRock

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved