Global Financial Services Operational Risk Management Solution Market Forecast: Industry Size, Growth and Analysis Insights

Report ID : 1406865 | Published : August 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Financial Services Operational Risk Management Solution Market is categorized based on Technology Type (Software Solutions, Cloud-based Solutions, On-premise Solutions, Consulting Services, Managed Services) and Deployment Mode (On-premise, Cloud-based, Hybrid) and End-User (Banks, Insurance Companies, Investment Firms, Asset Management Firms, Fintech Companies) and Application (Regulatory Compliance, Fraud Detection, Risk Assessment, Incident Management, Data Management) and Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

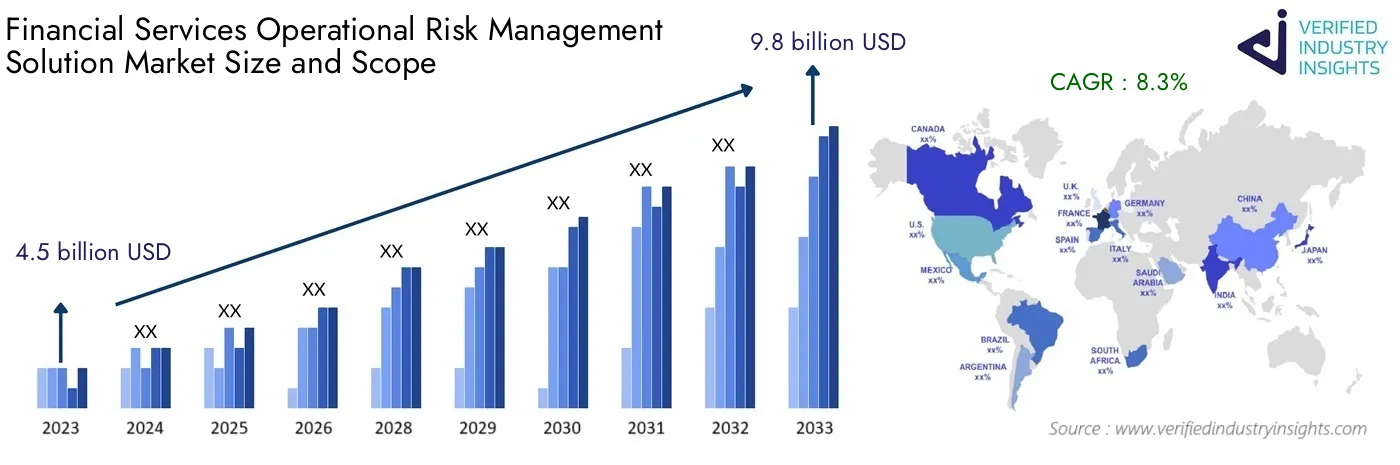

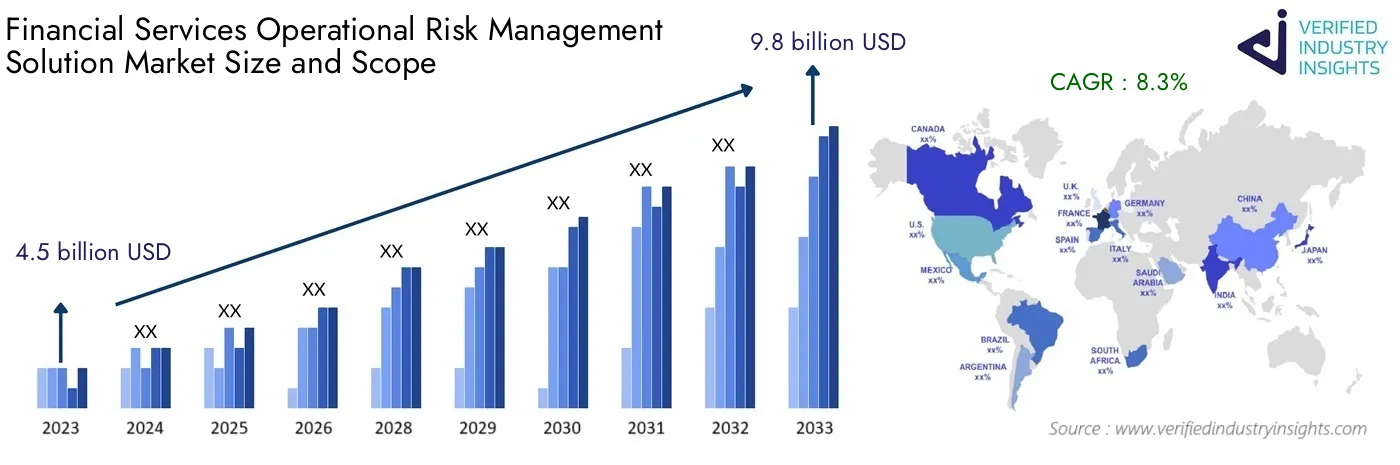

Estimated at 4.5 billion USD in 2023, the Financial Services Operational Risk Management Solution Market size is forecasted to reach 9.8 billion USD by 2033, exhibiting a CAGR of 8.3% between 2024 and 2033. The report includes various segments and analyzes key trends and factors that play a significant role in the market.

The Financial Services Operational Risk Management Solution Market is undergoing changes as the requirements around complexity and risk management systems tend to be increasing over time. There seems to be an increasing demand for sophisticated operational risk management solutions for compliance with the everchanging regulatory environment as well as the uncertainties of the market. These tools aid in compliance with regulation, but moreover they assist the financial services sector in identifying risks and keeping them at bay which is necessary in the current market state.

In this context, the market is witnessing innovative advancements in technology, with artificial intelligence and machine learning playing pivotal roles in the development of more efficient risk management systems. These tools help in creating timely data and trend analyses for more robust processes in the management of future threat instances. With the global shift of focus being towards more operational efficiency in financial services, incorporating advanced risk mitigation solutions is now a matter of staying afloat.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | IBM Corporation, Oracle Corporation, SAS Institute Inc., SAP SE, FIS Global, RiskWatch International, MetricStream Inc., LogicManager, Wolters Kluwer, Aon plc, Marsh & McLennan Companies |

| SEGMENTS COVERED |

By Technology Type - Software Solutions, Cloud-based Solutions, On-premise Solutions, Consulting Services, Managed Services

By Deployment Mode - On-premise, Cloud-based, Hybrid

By End-User - Banks, Insurance Companies, Investment Firms, Asset Management Firms, Fintech Companies

By Application - Regulatory Compliance, Fraud Detection, Risk Assessment, Incident Management, Data Management

By Organization Size - Small and Medium Enterprises (SMEs), Large Enterprises

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Financial Services Operational Risk Management Solution Market Dynamics

The Financial Services Operational Risk Management Solution Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Financial Services Operational Risk Management Solution Market Segmentations

Market Breakup by Technology Type

- Overview

- Software Solutions

- Cloud-based Solutions

- On-premise Solutions

- Consulting Services

- Managed Services

Market Breakup by Deployment Mode

- Overview

- On-premise

- Cloud-based

- Hybrid

Market Breakup by End-User

- Overview

- Banks

- Insurance Companies

- Investment Firms

- Asset Management Firms

- Fintech Companies

Market Breakup by Application

- Overview

- Regulatory Compliance

- Fraud Detection

- Risk Assessment

- Incident Management

- Data Management

Market Breakup by Organization Size

- Overview

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Financial Services Operational Risk Management Solution Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- IBM Corporation

- Oracle Corporation

- SAS Institute Inc.

- SAP SE

- FIS Global

- RiskWatch International

- MetricStream Inc.

- LogicManager

- Wolters Kluwer

- Aon plc

- Marsh & McLennan Companies

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved