Global Fine Art Insurance Industry Insights: Market Size, Growth Analysis and Forecast

Report ID : 1407089 | Published : May 2025 | Study Period : 2023-2033 | Format : PDF + Excel

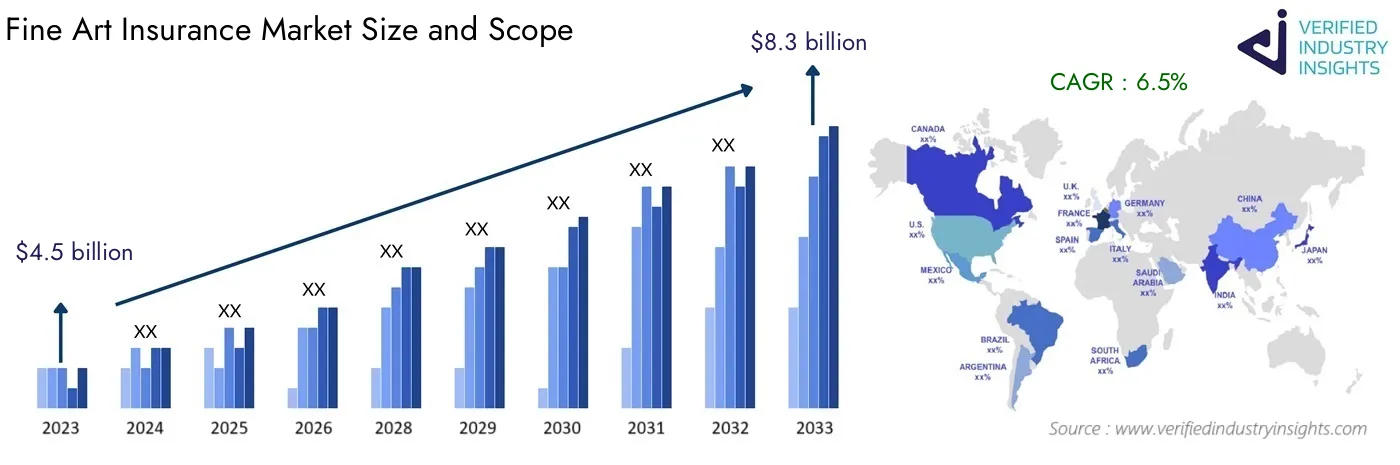

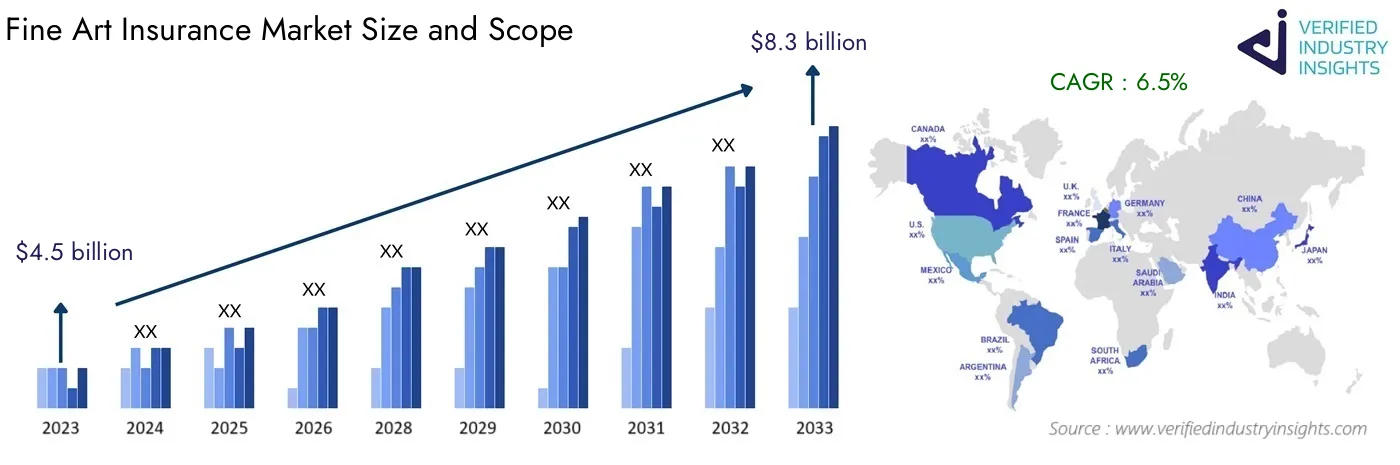

The market size of the Fine Art Insurance Industry is categorized based on Type of Art (Fine Art, Antique Art, Modern Art, Contemporary Art, Sculptures) and Insurance Type (All-Risk Insurance, Named Perils Insurance, Transit Insurance, Exhibition Insurance, Storage Insurance) and End-User (Individual Collectors, Art Galleries, Museums, Art Dealers, Auction Houses) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

The Fine Art Insurance Industry was worth $4.5 billion in 2023 and is forecasted to reach $8.3 billion by 2033, growing at a CAGR of 6.5% over the period 2024-2033. This report covers various segments and analyzes the key trends and factors influencing the market significantly.

Insurance coverage dealing with high-value artworks is referred to as fine art insurance, and this field has not only become more important but also elaborate the last few decades. This growth of this sector can be attributed to the appreciation of wealth among collectors, extensive marketing of art as a form of investment, and global expansion of the art market. Artworks are often regarded as a store of value, and damages to them, as well as theft, physically and monetarily damage them. In addition, works of art pose unique challenges in terms of valuation which often requires auctioneers and valuers to assess an artwork and determine it worth.

With the passage of time, fine art insurances have widened their boundaries owing to digitalization of selling artwork, the importance of art provenance, and authenticity of art pieces. For further expansion of the industry, collectors, galleries, as well as institutions are now required to expand and adapt their cover policies, for elderly policies have prove inadequate to resolve and cover damages incurred. This improvement is even more emphasized with the recent coverage of the digital and contemporary art pieces that require added insurances as well as increased art thefts.

While analyzing the Fine Art Insurance Market, it is imperative to note the important trends, challenges and growth prospects defining this sector. With this commentary, we hope to provide participants within this market the guidance necessary to address the complex nuances associated with ensuring priceless collections and investments.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | AXA Art Insurance, Chubb Limited, Lloyd's of London, Hiscox Ltd, AIG Private Client Group, Travelers Insurance, Liberty Mutual Insurance, Marsh & McLennan Companies, CNA Financial Corporation, Berkshire Hathaway, The Hartford |

| SEGMENTS COVERED |

By Type of Art - Fine Art, Antique Art, Modern Art, Contemporary Art, Sculptures

By Insurance Type - All-Risk Insurance, Named Perils Insurance, Transit Insurance, Exhibition Insurance, Storage Insurance

By End-User - Individual Collectors, Art Galleries, Museums, Art Dealers, Auction Houses

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Fine Art Insurance Industry Dynamics

The Fine Art Insurance Industry is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Fine Art Insurance Industry Segmentations

Market Breakup by Type of Art

- Overview

- Fine Art

- Antique Art

- Modern Art

- Contemporary Art

- Sculptures

Market Breakup by Insurance Type

- Overview

- All-Risk Insurance

- Named Perils Insurance

- Transit Insurance

- Exhibition Insurance

- Storage Insurance

Market Breakup by End-User

- Overview

- Individual Collectors

- Art Galleries

- Museums

- Art Dealers

- Auction Houses

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Fine Art Insurance Industry

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- AXA Art Insurance

- Chubb Limited

- Lloyd's of London

- Hiscox Ltd

- AIG Private Client Group

- Travelers Insurance

- Liberty Mutual Insurance

- Marsh & McLennan Companies

- CNA Financial Corporation

- Berkshire Hathaway

- The Hartford

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved