In-Depth AFCC Debt Settlement Market Trends, Size, and Strategic Opportunities

Report ID : 866360 | Published : September 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the AFCC Debt Settlement Market is categorized based on Debt Relief Services (Negotiation Services, Consultation Services, Financial Education Programs, Debt Management Plans, Credit Counseling) and Debt Settlement Types (Unsecured Debt Settlement, Secured Debt Settlement, Business Debt Settlement, Tax Debt Settlement, Student Loan Settlement) and Consumer Segments (Individual Consumers, Small Business Owners, Corporate Clients, Non-Profit Organizations, Low-Income Households) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

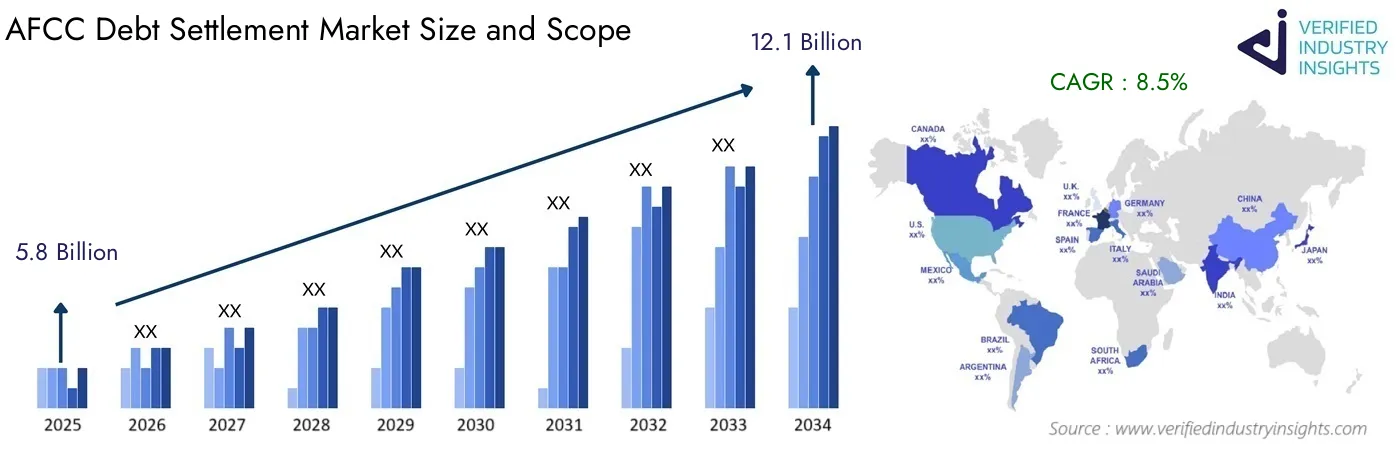

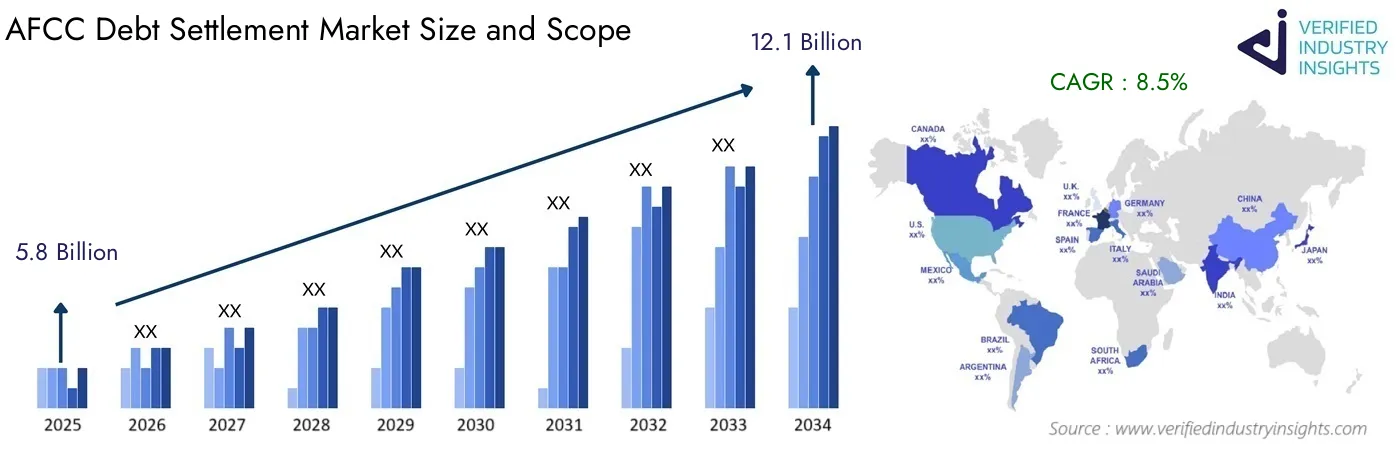

Valued at 5.8 billion USD in 2025, the AFCC Debt Settlement Market size is expected to grow to 12.1 billion USD by 2034, with a CAGR of 8.5% from 2026 to 2034. The report comprises various segments and analyzes the trends and factors playing a substantial role in the market.

AFCC Debt Settlement Market Introduction

Between 2023 and 2033, the AFCC Debt Settlement Market is thoroughly analyzed during the forecast period. This evaluation meticulously investigates various segments, dissecting current trends and key factors that shape the market's trajectory. A comprehensive analysis of market dynamics—including drivers, restraints, opportunities, and challenges—is conducted to understand their cumulative impact on the market. This study considers both internal elements like drivers and restraints and external factors such as market opportunities and challenges. The current market research offers insights into the market's revenue development throughout the projected period.

Providing an extensive compilation of information for a specific market segment, the AFCC Debt Settlement Market report offers an in-depth overview within a particular industry or across multiple sectors. This comprehensive report employs both quantitative and qualitative analyses to forecast trends from 2023 to 2033. Factors considered include product pricing, the degree of product or service penetration at national and regional levels, national GDP, dynamics within the main market and its submarkets, end-use industries, key players, consumer behavior, and the economic and social environments of various countries. The detailed segmentation of the report ensures a thorough analysis of the market from multiple perspectives.

This exhaustive report extensively explores essential sections, including market segments, market outlook, competitive landscape, and company profiles. The segments provide detailed insights from different angles, considering factors like end-use industry, product or service classification, and other relevant categorizations aligned with the current market scenario. These aspects collectively aid in streamlining future marketing activities.

Within the market outlook section, a thorough investigation of the market's progression is undertaken, examining growth drivers, restraints, opportunities, and challenges. This encompasses an extensive exploration of Porter's Five Forces Framework, macroeconomic analysis, value chain evaluation, and detailed pricing analysis-all significantly impacting the current market scenario and expected to influence it throughout the forecast period. Internal market factors are articulated through drivers and restraints, while external influences are detailed in terms of opportunities and challenges. Furthermore, this section provides valuable insights into prevailing trends influencing new business ventures and investment prospects.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | National Debt Relief, Freedom Debt Relief, CuraDebt, Accredited Debt Relief, Breeze Financial, New Era Debt Solutions, Achieve Financial, DebtWave Credit Counseling, Pacific Debt, InCharge Debt Solutions, American Debt Enders |

| SEGMENTS COVERED |

By Debt Relief Services - Negotiation Services, Consultation Services, Financial Education Programs, Debt Management Plans, Credit Counseling

By Debt Settlement Types - Unsecured Debt Settlement, Secured Debt Settlement, Business Debt Settlement, Tax Debt Settlement, Student Loan Settlement

By Consumer Segments - Individual Consumers, Small Business Owners, Corporate Clients, Non-Profit Organizations, Low-Income Households

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

AFCC Debt Settlement Market Dynamics

The AFCC Debt Settlement Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

AFCC Debt Settlement Market Segmentations

Market Breakup by Debt Relief Services

- Overview

- Negotiation Services

- Consultation Services

- Financial Education Programs

- Debt Management Plans

- Credit Counseling

Market Breakup by Debt Settlement Types

- Overview

- Unsecured Debt Settlement

- Secured Debt Settlement

- Business Debt Settlement

- Tax Debt Settlement

- Student Loan Settlement

Market Breakup by Consumer Segments

- Overview

- Individual Consumers

- Small Business Owners

- Corporate Clients

- Non-Profit Organizations

- Low-Income Households

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the AFCC Debt Settlement Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- National Debt Relief

- Freedom Debt Relief

- CuraDebt

- Accredited Debt Relief

- Breeze Financial

- New Era Debt Solutions

- Achieve Financial

- DebtWave Credit Counseling

- Pacific Debt

- InCharge Debt Solutions

- American Debt Enders

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved