Global Credit Processing Solution Industry Insights: Market Size, Growth Analysis and Forecast

Report ID : 1307867 | Published : May 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Credit Processing Solution Industry is categorized based on Payment Processing (Credit Card Processing, Mobile Payments, Online Payments, Point of Sale (POS) Systems, Recurring Billing) and Fraud Detection and Prevention (Transaction Monitoring, Identity Verification, Chargeback Management, Risk Assessment Tools, Fraud Analytics) and Merchant Services (Payment Gateways, Merchant Accounts, Payment Terminal Solutions, E-commerce Solutions, Mobile Wallet Services) and Technology Solutions (Payment APIs, Integration Services, Blockchain Technology, Artificial Intelligence Solutions, Cloud-based Solutions) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

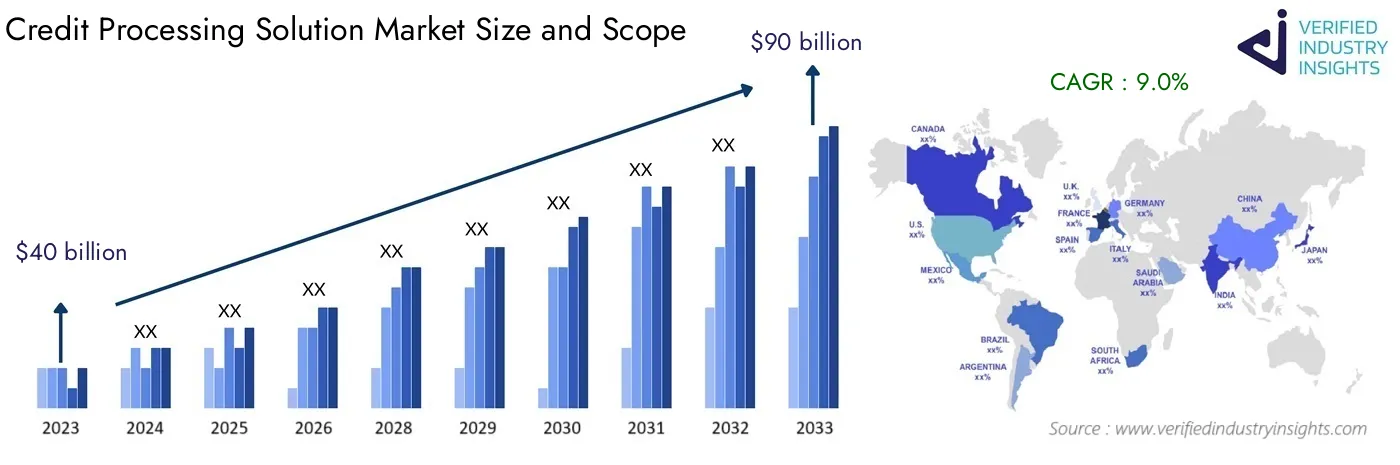

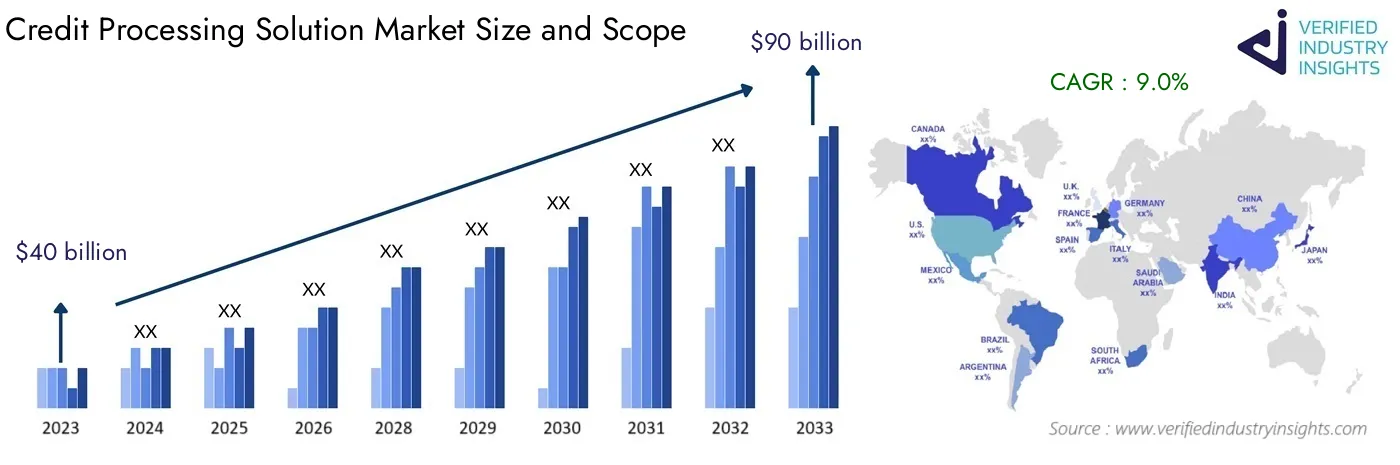

The Credit Processing Solution Industry was worth $40 billion in 2023 and is forecasted to reach $90 billion by 2033, growing at a CAGR of 9.0% over the period 2024-2033. This report covers various segments and analyzes the key trends and factors influencing the market significantly.

Similar to other traditional splits, the Credit Processing Solution Market is also witnessing drastic technological trends that have thoroughly redefined the industry's landscape. With an upsurge in the use of digital payment systems, the supply of user-friendly, reliable, and safe credit processing solutions is increasing. Businesses in all sectors are realizing the importance of adopting sophisticated credit processing technologies in order to improve customer satisfaction, enhance operational efficiencies, and lower payment processing risks. This, clearly improves the businesses’ revenue, while also ensuring compliance with the shifting industry regulations.

While exploring the nuances of the credit processing solutions market, it becomes apparent that the technologies that are shaping advancement include Artificial Intelligence, Machine Learning and Blockchain. Their novel application alters the history and sensed infrastructure of credit transactions. Organizations can now use these technologies to analyze their customers purchasing patterns, make smarter credit decisions, and identify cases of fraud more effectively. Technology gets more sophisticated as competition increases which enables us to better target our customers with our comprehensive market research reports tailored to meet their strategic needs for sustained marketplace improvements and organizational growth.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., Square Inc., Stripe Inc., Adyen N.V., Worldpay Inc., FIS Global, Global Payments Inc., Clover Network Inc., Authorize.Net, Alipay |

| SEGMENTS COVERED |

By Payment Processing - Credit Card Processing, Mobile Payments, Online Payments, Point of Sale (POS) Systems, Recurring Billing

By Fraud Detection and Prevention - Transaction Monitoring, Identity Verification, Chargeback Management, Risk Assessment Tools, Fraud Analytics

By Merchant Services - Payment Gateways, Merchant Accounts, Payment Terminal Solutions, E-commerce Solutions, Mobile Wallet Services

By Technology Solutions - Payment APIs, Integration Services, Blockchain Technology, Artificial Intelligence Solutions, Cloud-based Solutions

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Credit Processing Solution Industry Dynamics

The Credit Processing Solution Industry is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Credit Processing Solution Industry Segmentations

Market Breakup by Payment Processing

- Overview

- Credit Card Processing

- Mobile Payments

- Online Payments

- Point of Sale (POS) Systems

- Recurring Billing

Market Breakup by Fraud Detection and Prevention

- Overview

- Transaction Monitoring

- Identity Verification

- Chargeback Management

- Risk Assessment Tools

- Fraud Analytics

Market Breakup by Merchant Services

- Overview

- Payment Gateways

- Merchant Accounts

- Payment Terminal Solutions

- E-commerce Solutions

- Mobile Wallet Services

Market Breakup by Technology Solutions

- Overview

- Payment APIs

- Integration Services

- Blockchain Technology

- Artificial Intelligence Solutions

- Cloud-based Solutions

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Credit Processing Solution Industry

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- Square Inc.

- Stripe Inc.

- Adyen N.V.

- Worldpay Inc.

- FIS Global

- Global Payments Inc.

- Clover Network Inc.

- Authorize.Net

- Alipay

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved