Global Digital Asset Trading System Development Market Forecast: Industry Size, Growth and Analysis Insights

Report ID : 1310673 | Published : July 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Digital Asset Trading System Development Market is categorized based on Trading Platforms (Centralized Exchanges, Decentralized Exchanges, Over-the-Counter Platforms) and Services (Consulting Services, Integration Services, Maintenance Services) and Technology (Blockchain Technology, Smart Contracts, Tokenization Solutions) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

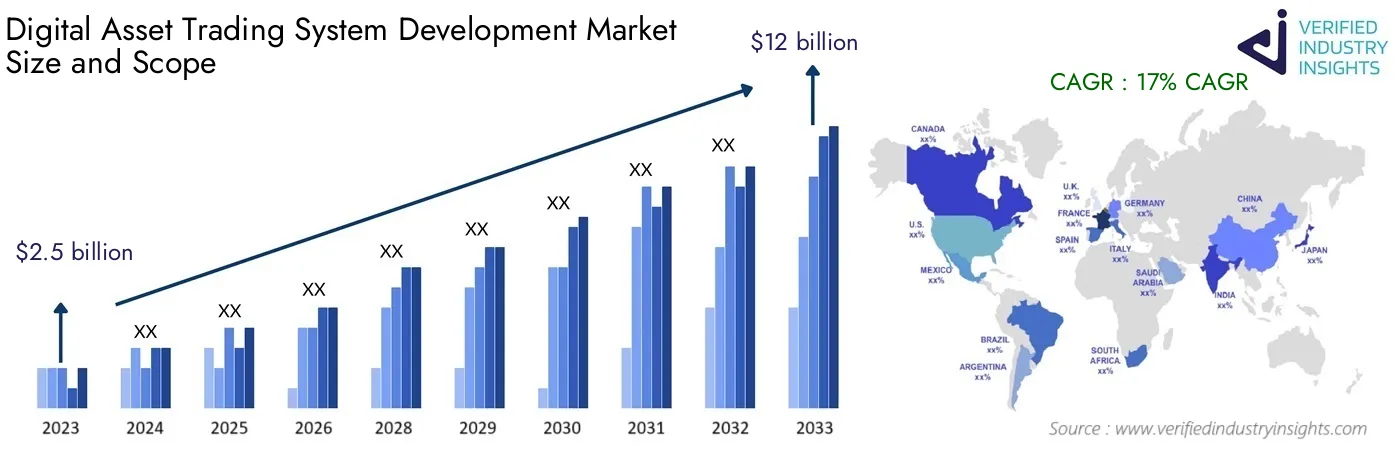

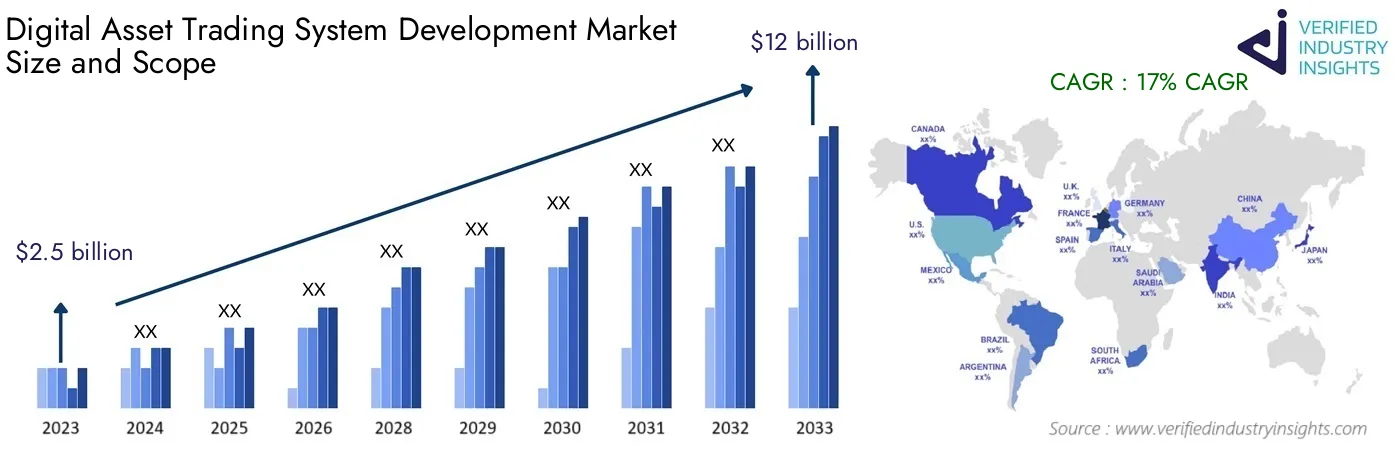

Estimated at $2.5 billion in 2023, the Digital Asset Trading System Development Market size is forecasted to reach $12 billion by 2033, exhibiting a CAGR of 17% CAGR between 2024 and 2033. The report includes various segments and analyzes key trends and factors that play a significant role in the market.

Expanding systems for trading digital assets need sophisticated technology in the modern world because there is an increasing need for safety, transparency, and trade execution efficiency throughout the entire system. Cryptocurrency has pushed many individuals across the world into actively trading by acting as a catalyst for change, but apart from that tokens and various forms of assets have enabled platforms to automate trades for users through algorithmic trading. Additionally, the trading experience can be made even more efficient with the help of modern technologies like blockchain, AI, and machine learning.

The current changes in the ecosystem that stems from the introduction of new forms of digital assets has financial institutions along with emergent start-ups coming up with innovative solutions to revolutionize their existing framework and automated systems. Non-fungible tokens (NFT) and DeFi (decentralized finance) have catalyzed this change even further by creating a multifaceted marketplace that needs extensive trading infrastructure. Due to this reason, systems for developing trading platforms for different asset classes is gaining rapid traction making it an attractive venture for companies at the moment.

This is clearly impactful; while exploring the market further, it is necessary to analyze the critical trends, challenges, and opportunities that shape its contours. Digital assets and technology are industries that are evolving remarkably given the competitive landscape, and organizations need to constantly innovate in order to retain their competitive advantage. With regard to the mentioned market, our foresight is aimed at providing an overview of the state of the art that will be useful for stakeholders who need to operate in this highly dynamic environment.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | Binance, Coinbase, Kraken, Gemini, Bitfinex, Huobi, Bittrex, eToro, Paxful, OKEx, Bitstamp |

| SEGMENTS COVERED |

By Trading Platforms - Centralized Exchanges, Decentralized Exchanges, Over-the-Counter Platforms

By Services - Consulting Services, Integration Services, Maintenance Services

By Technology - Blockchain Technology, Smart Contracts, Tokenization Solutions

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Digital Asset Trading System Development Market Dynamics

The Digital Asset Trading System Development Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Digital Asset Trading System Development Market Segmentations

Market Breakup by Trading Platforms

- Overview

- Centralized Exchanges

- Decentralized Exchanges

- Over-the-Counter Platforms

Market Breakup by Services

- Overview

- Consulting Services

- Integration Services

- Maintenance Services

Market Breakup by Technology

- Overview

- Blockchain Technology

- Smart Contracts

- Tokenization Solutions

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Digital Asset Trading System Development Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- Binance

- Coinbase

- Kraken

- Gemini

- Bitfinex

- Huobi

- Bittrex

- eToro

- Paxful

- OKEx

- Bitstamp

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved