Global Instant Payments Market Forecast: Industry Size, Growth and Analysis Insights

Report ID : 1330672 | Published : August 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Instant Payments Market is categorized based on Payment Methods (Credit Cards, Debit Cards, Mobile Wallets, Bank Transfers, Cryptocurrency) and End-User Industries (Retail, Banking, Insurance, Travel and Hospitality, Utilities) and Deployment Type (Cloud-Based, On-Premises) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

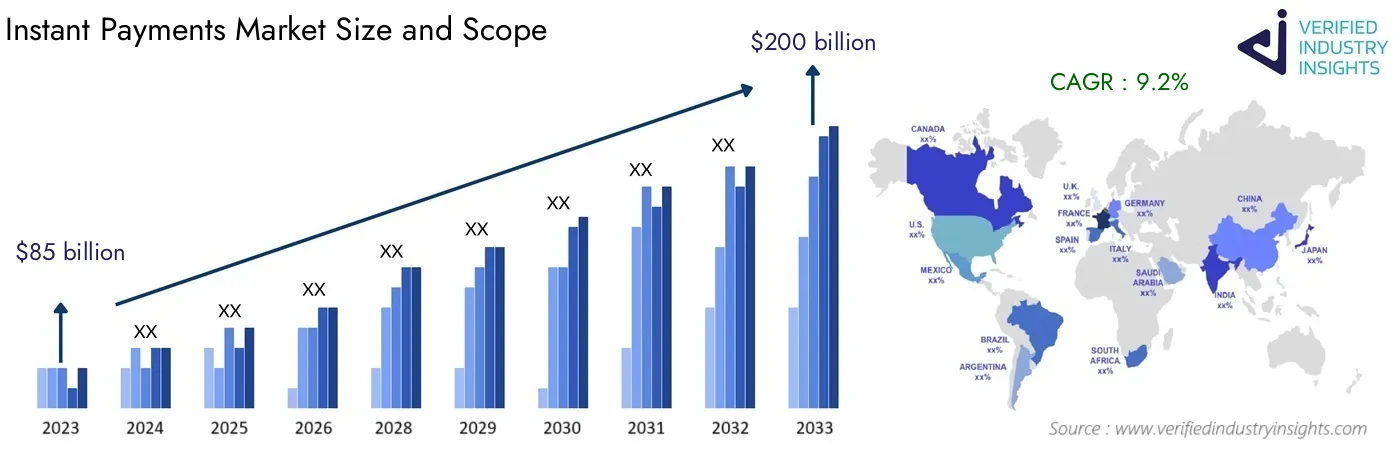

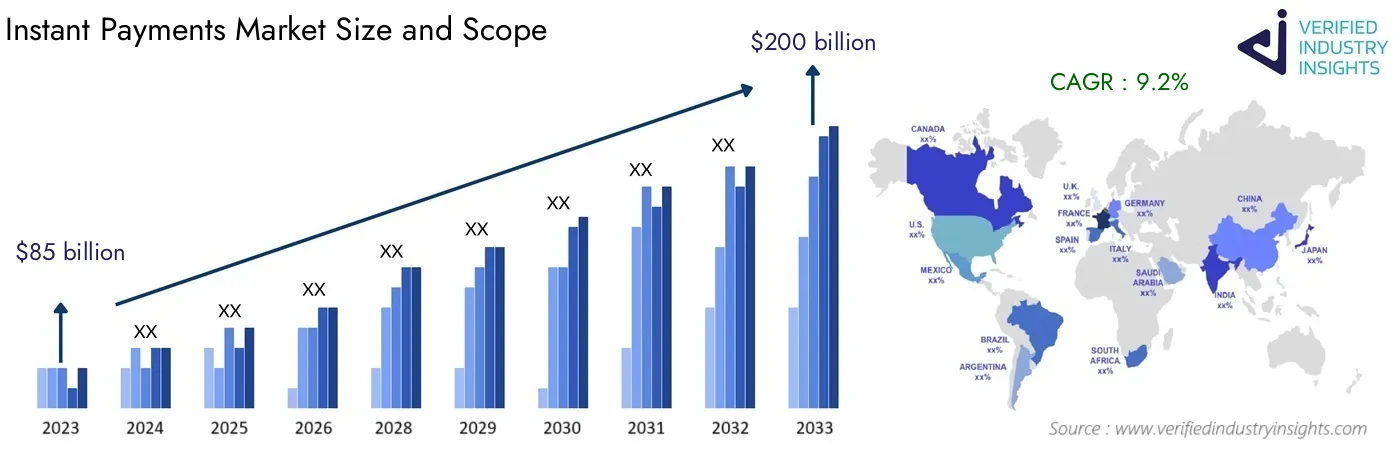

Estimated at $85 billion in 2023, the Instant Payments Market size is forecasted to reach $200 billion by 2033, exhibiting a CAGR of 9.2% between 2024 and 2033. The report includes various segments and analyzes key trends and factors that play a significant role in the market.

A wide variety of factors are getting the demand for financial transactions, specifically payments, to be conducted in real time as instantaneous as possible. Technological advancements on both sides of the industry are rendering economical resources significantly more favorable and accessible, making it possible for consumers to experience ease-of-use.

Payment needs are responding fluidly to the changes undertaken by revolutions in informatics. Effectively and instantly payable types of payments have reshaped the customer ideology and expectations concerning efficacy. The yield of lessening interventions by financiers, alongside the enablement of ready liquidity inside whole network-of-banks payment systems furnish further development potential concerning added services.

The expansion of new markets such as mobile wallets, mobile payment applications, and blockchain have altogether accelerated the instant payment system adoption globally. Instant Payment Systems have the attributes of efficacy coupled with ultimate safety, with trustworthy and stable instant payment policies—being crucial towards a firm’s growth. Instant Payments Market is discussed in depth including research over key trends of the rapidly changing market, opportunities, and challenges pertaining to mobile wallets, smartphones, and blockchain advancement for the forward-looking enterprises aiming for sharpening edge in competitive markets.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | PayPal, Visa Inc., Mastercard, Square Inc., Adyen, Stripe, Worldpay, FIS, Payoneer, Zelle, Alipay |

| SEGMENTS COVERED |

By Payment Methods - Credit Cards, Debit Cards, Mobile Wallets, Bank Transfers, Cryptocurrency

By End-User Industries - Retail, Banking, Insurance, Travel and Hospitality, Utilities

By Deployment Type - Cloud-Based, On-Premises

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Instant Payments Market Dynamics

The Instant Payments Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Instant Payments Market Segmentations

Market Breakup by Payment Methods

- Overview

- Credit Cards

- Debit Cards

- Mobile Wallets

- Bank Transfers

- Cryptocurrency

Market Breakup by End-User Industries

- Overview

- Retail

- Banking

- Insurance

- Travel and Hospitality

- Utilities

Market Breakup by Deployment Type

- Overview

- Cloud-Based

- On-Premises

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Instant Payments Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- PayPal

- Visa Inc.

- Mastercard

- Square Inc.

- Adyen

- Stripe

- Worldpay

- FIS

- Payoneer

- Zelle

- Alipay

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved