Mobile Banking Software Solution Industry Global Overview: Market Size, Growth Insights and Forecast

Report ID : 1341020 | Published : July 2025 | Study Period : 2023-2033 | Format : PDF + Excel

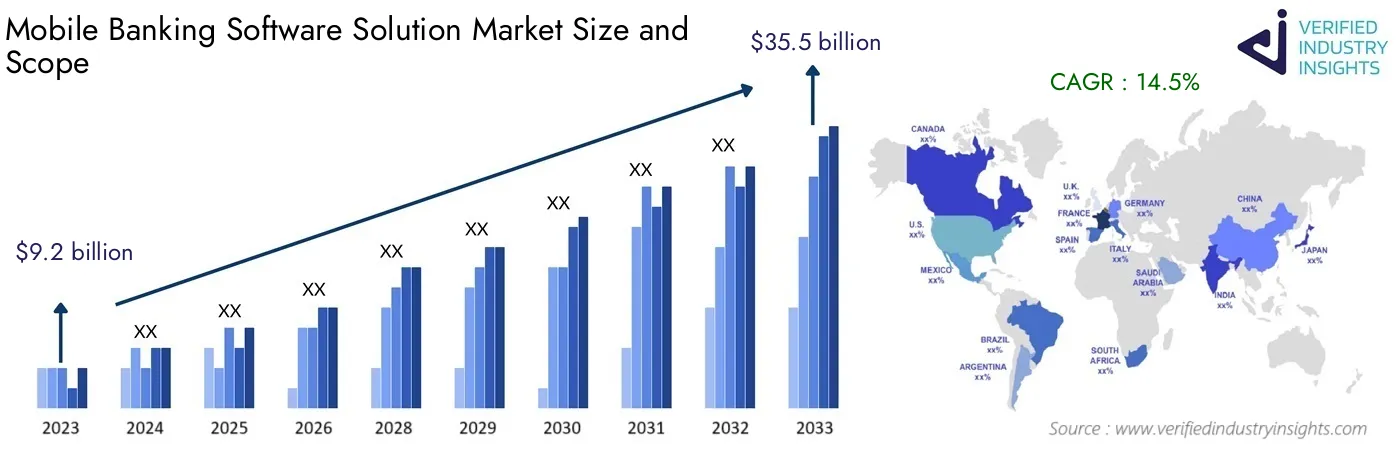

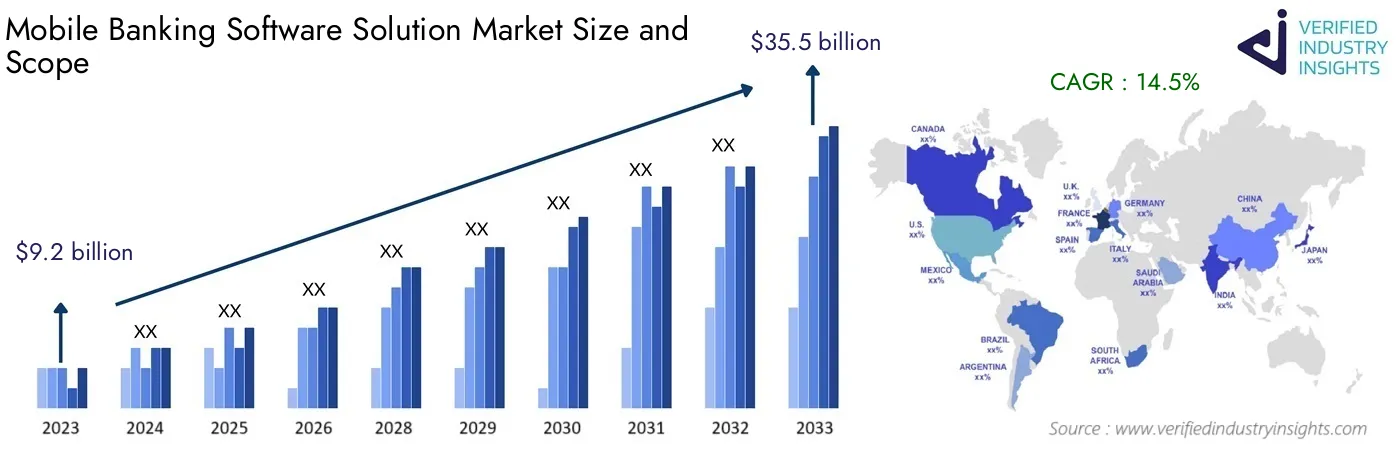

The market size of the Mobile Banking Software Solution Industry is categorized based on Deployment Type (On-Premises, Cloud-Based) and Application Type (Personal Banking, Corporate Banking, Investment Banking) and End User (Banks, Credit Unions, Insurance Companies, Investment Firms) and Features (Payment Processing, Account Management, Customer Support, Fraud Detection, Analytics and Reporting) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

The Mobile Banking Software Solution Industry, valued at $9.2 billion in 2023, is anticipated to expand to $35.5 billion by 2033 at a CAGR of 14.5% from 2024 to 2033. This report covers different segments and offers an analysis of the substantial trends and factors affecting the market.

The Mobile Banking Software Solution Market is in its total upheaval period owing to the increasing digitalization of financial services and the growing need of consumers to have a smooth banking experience. With consumers moving to their mobile phones for most of their banking needs, it becomes imperative for the financial institutions to use sophisticated mobile banking solutions to improve their retention and performance. This raises the question as to whether banks, fintech companies and software developers all would be able to cope with the competition and invent new products to satisfy the needs and wishes of intelligent and cabal consumers.

In such a scenario, mobile banking software solutions have become fundamental to achieving goals such as providing consumers with target services in a simple, secure, and efficient manner. For example, constant access to real-time transactions, intuitive design, and powerful protection – all these enable the banks to sustain competitive advantage in the market. Going further, given the rise of mobile banking, it will be vital for businesses, investors, M&A professionals and other stakeholders aiming to take advantage of the upcoming chances to comprehend the trends, driving forces, and competitive landscape within this sphere.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | FIS, Temenos AG, NCR Corporation, Oracle Corporation, SAP SE, Diebold Nixdorf, Kony Inc., Backbase, Amdocs, Intellect Design Arena, Zeta Tech |

| SEGMENTS COVERED |

By Deployment Type - On-Premises, Cloud-Based

By Application Type - Personal Banking, Corporate Banking, Investment Banking

By End User - Banks, Credit Unions, Insurance Companies, Investment Firms

By Features - Payment Processing, Account Management, Customer Support, Fraud Detection, Analytics and Reporting

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Mobile Banking Software Solution Industry Dynamics

The Mobile Banking Software Solution Industry is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Mobile Banking Software Solution Industry Segmentations

Market Breakup by Deployment Type

- Overview

- On-Premises

- Cloud-Based

Market Breakup by Application Type

- Overview

- Personal Banking

- Corporate Banking

- Investment Banking

Market Breakup by End User

- Overview

- Banks

- Credit Unions

- Insurance Companies

- Investment Firms

Market Breakup by Features

- Overview

- Payment Processing

- Account Management

- Customer Support

- Fraud Detection

- Analytics and Reporting

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Mobile Banking Software Solution Industry

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- FIS

- Temenos AG

- NCR Corporation

- Oracle Corporation

- SAP SE

- Diebold Nixdorf

- Kony Inc.

- Backbase

- Amdocs

- Intellect Design Arena

- Zeta Tech

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved