Global Onsite and offsite ATMs Industry Insights: Market Size, Growth Analysis and Forecast

Report ID : 1346425 | Published : May 2025 | Study Period : 2023-2033 | Format : PDF + Excel

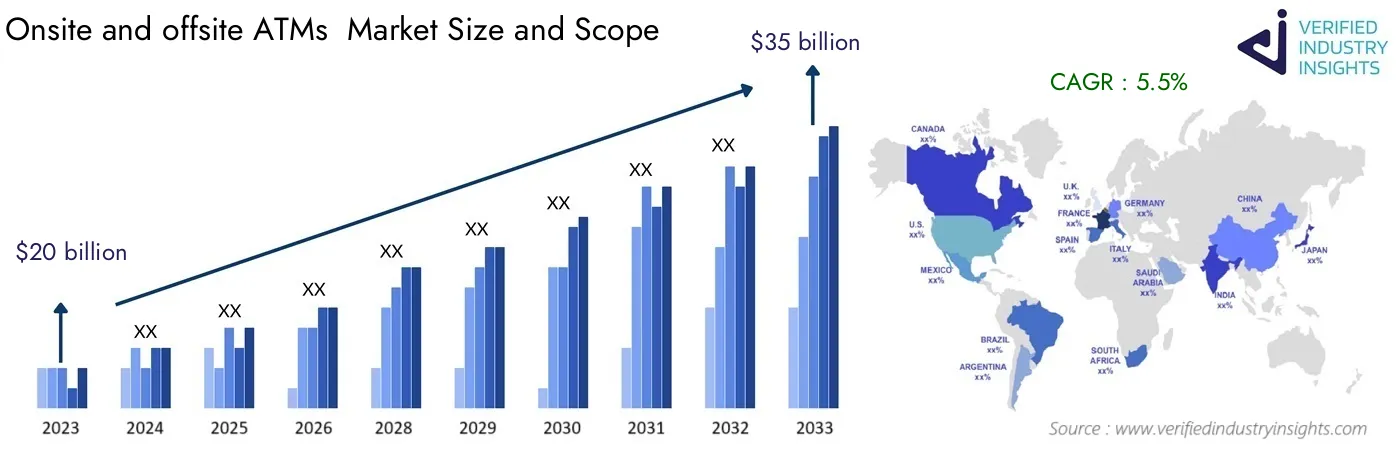

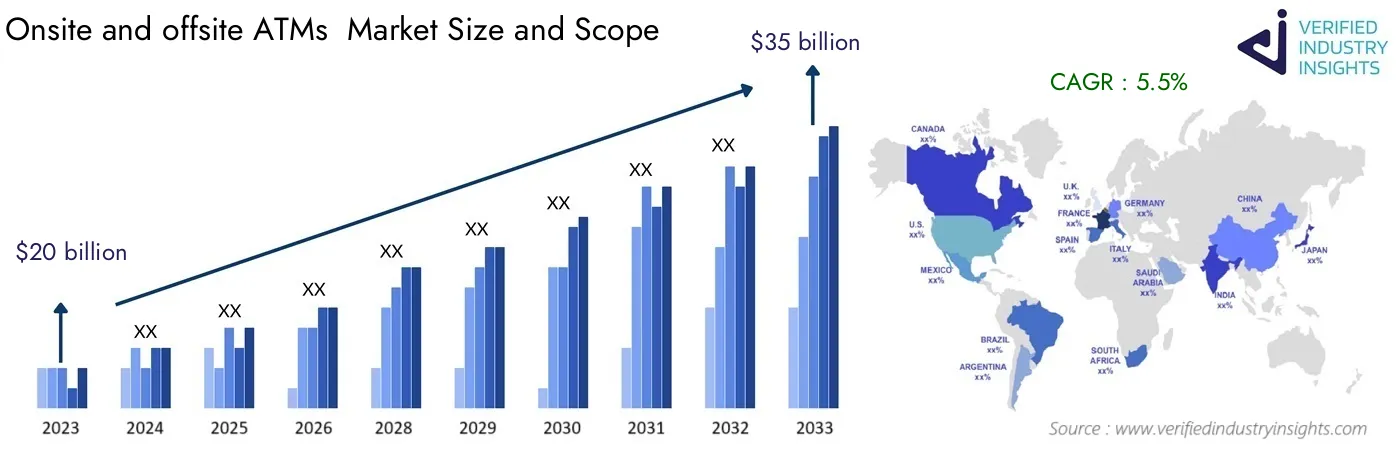

The market size of the Onsite And Offsite ATMs Industry is categorized based on Type (Onsite ATMs, Offsite ATMs) and Deployment (Bank-owned ATMs, Independent ATMs, Retail ATMs) and Technology (Cash Dispenser ATMs, Multi-functional ATMs, Smart ATMs) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

The Onsite And Offsite ATMs Industry was worth $20 billion in 2023 and is forecasted to reach $35 billion by 2033, growing at a CAGR of 5.5% over the period 2024-2033. This report covers various segments and analyzes the key trends and factors influencing the market significantly.

The Onsite and Offsite ATMs market is alreay evolving with the new emerging technologies and consumer demads. Financial institutions are shifting to more automated services, increasing customer convenience which has led to the installation of Automated Teller Machines (ATMs) in areas beyond traditional bank branches. Customers seeking for quick transactions can have access to onsite ATMs, typically located within bank premises. Offsite ATMs can also be found in high-traffic areas such as shopping centers and airports which helps to meet the growing demand for cash access in diverse environments.

Innovation plays a major role directly impacting this market as these ATMs have to face competition. Consumer interaction with ATMs has started improving with the addition of contactless transactions, mobile banking, and ATMs having high security features. Businesses are also trying to boost customer satisfaction and improve their efficiency, which motivates them to use onsite and offsite ATMs as boundaries to meet the diverse demands of their customers. Understanding the dynamics of the financial services sector is crucial for stakeholders undertaking the competition.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | NCR Corporation, Diebold Nixdorf, GRG Banking, Hitachi-Omron Terminal Solutions, Fujitsu, Wincor Nixdorf, KAL ATM Software, HESS Cash Systems, Triton Systems, RBR, Cardtronics |

| SEGMENTS COVERED |

By Type - Onsite ATMs, Offsite ATMs

By Deployment - Bank-owned ATMs, Independent ATMs, Retail ATMs

By Technology - Cash Dispenser ATMs, Multi-functional ATMs, Smart ATMs

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Onsite And Offsite ATMs Industry Dynamics

The Onsite And Offsite ATMs Industry is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Onsite And Offsite ATMs Industry Segmentations

Market Breakup by Type

- Overview

- Onsite ATMs

- Offsite ATMs

Market Breakup by Deployment

- Overview

- Bank-owned ATMs

- Independent ATMs

- Retail ATMs

Market Breakup by Technology

- Overview

- Cash Dispenser ATMs

- Multi-functional ATMs

- Smart ATMs

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Onsite And Offsite ATMs Industry

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- NCR Corporation

- Diebold Nixdorf

- GRG Banking

- Hitachi-Omron Terminal Solutions

- Fujitsu

- Wincor Nixdorf

- KAL ATM Software

- HESS Cash Systems

- Triton Systems

- RBR

- Cardtronics

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved