Global Whole juvenile life insurance Market Growth: Industry Size, Analysis and Forecast

Report ID : 1378235 | Published : July 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Whole Juvenile Life Insurance Market is categorized based on Policy Type (Whole Life Insurance, Universal Life Insurance, Variable Life Insurance) and Distribution Channel (Direct Sales, Brokers, Banks, Online Platforms) and Age Group (0-5 years, 6-10 years, 11-15 years, 16-20 years) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

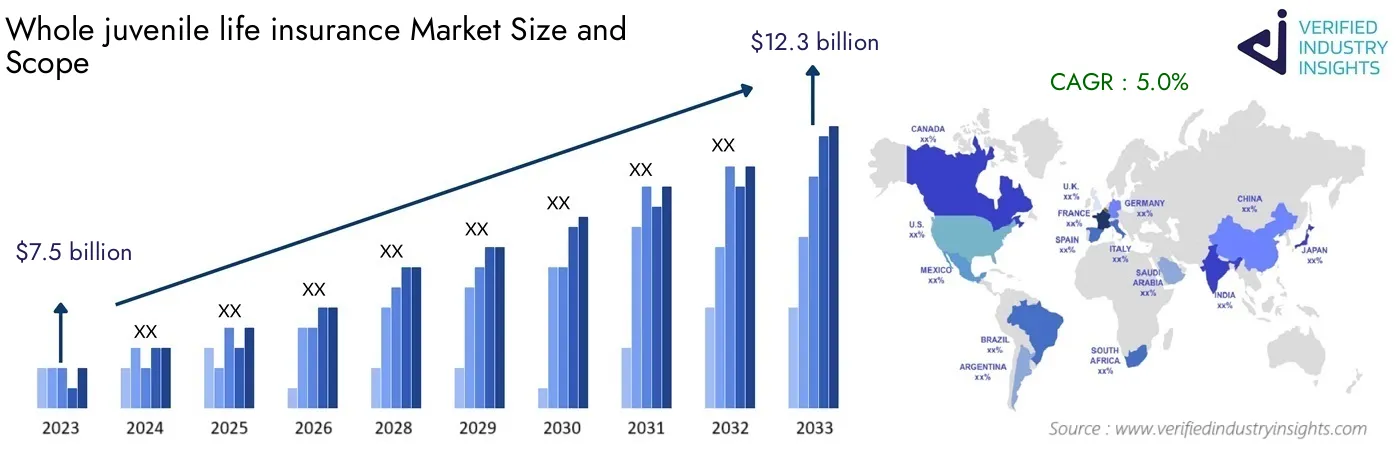

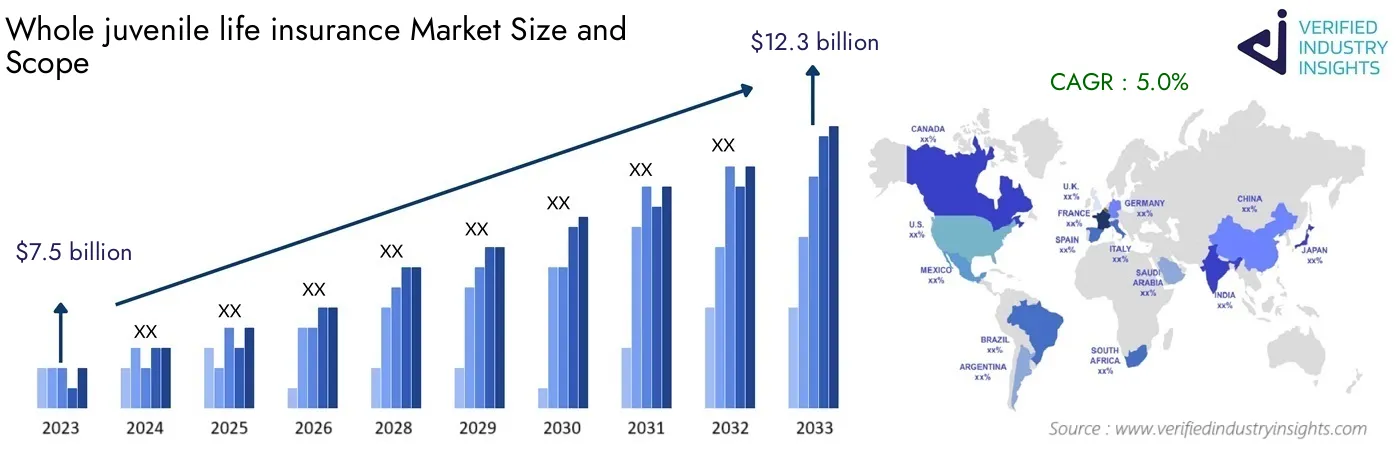

The market size of Whole Juvenile Life Insurance Market, valued at $7.5 billion in 2023, is projected to reach $12.3 billion by 2033, expanding at a CAGR of 5.0% between 2024 and 2033. The report comprises various segments and analyzes significant trends and factors influencing market growth.

The Whole Juvenile Life Insurance market is a sub-category of the insurance industry that concentrates on offering security and savings plans targeted to children at early ages. This market has experienced notable expansion as parents and guardians are increasingly aware of planning and protecting their children’s finances. Whole juvenile life insurance policies protect children from unforeseen contingencies and are a form of investment as they build cash value over time. For families striving to safe guard their child’s financial well-being, these policies serve dual purposes which adds an unparalleled appeal.

Demand to get whole juvenile life insurance policies has grown tremendously in the last few years due to change in consumer behavior and shift towards proactive long-term financial planning. The shift shows that families plan more proactively for their children’s futures, getting products that not only have insurance but a potential for wealth accumulation. As these shifts take place, insurers are adapting their products and services to fit the emerging needs of parents and guardians which diversifies the policy options available in the market. It highlights the changing attitude among the consumers but also the recognition of life insurance as an increasingly important aspect of effective financial planning for the coming generations.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | Prudential Financial Inc., MetLife Inc., New York Life Insurance Company, Northwestern Mutual, The Guardian Life Insurance Company of America, State Farm Mutual Automobile Insurance Company, MassMutual Financial Group, AIG Life & Retirement, Transamerica Corporation, John Hancock Financial, Lincoln National Corporation |

| SEGMENTS COVERED |

By Policy Type - Whole Life Insurance, Universal Life Insurance, Variable Life Insurance

By Distribution Channel - Direct Sales, Brokers, Banks, Online Platforms

By Age Group - 0-5 years, 6-10 years, 11-15 years, 16-20 years

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Whole Juvenile Life Insurance Market Dynamics

The Whole Juvenile Life Insurance Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Whole Juvenile Life Insurance Market Segmentations

Market Breakup by Policy Type

- Overview

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

Market Breakup by Distribution Channel

- Overview

- Direct Sales

- Brokers

- Banks

- Online Platforms

Market Breakup by Age Group

- Overview

- 0-5 years

- 6-10 years

- 11-15 years

- 16-20 years

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Whole Juvenile Life Insurance Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- Prudential Financial Inc.

- MetLife Inc.

- New York Life Insurance Company

- Northwestern Mutual

- The Guardian Life Insurance Company of America

- State Farm Mutual Automobile Insurance Company

- MassMutual Financial Group

- AIG Life & Retirement

- Transamerica Corporation

- John Hancock Financial

- Lincoln National Corporation

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved