Global Horse Insurance Market Growth: Industry Size, Analysis and Forecast

Report ID : 1412571 | Published : May 2025 | Study Period : 2023-2033 | Format : PDF + Excel

The market size of the Horse Insurance Market is categorized based on Type of Coverage (Accident Insurance, Major Medical Insurance, Mortality Insurance, Liability Insurance, Surgical Insurance) and Policy Type (Individual Policies, Group Policies, Farm and Ranch Policies, Commercial Policies, Special Event Policies) and End User (Private Horse Owners, Professional Equestrians, Riding Schools, Breeders, Veterinary Clinics) and geographical regions (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

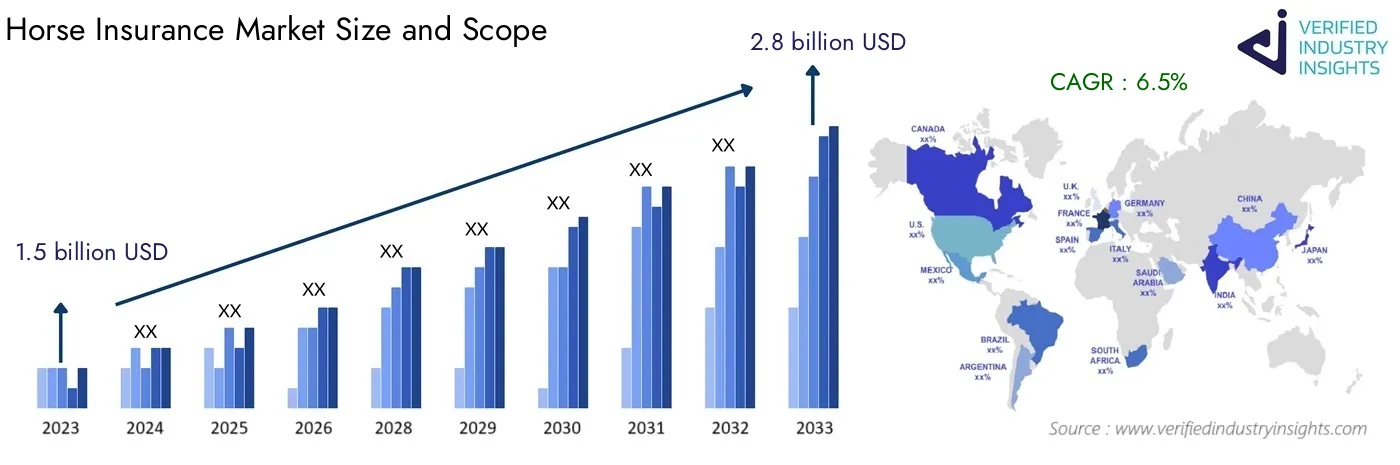

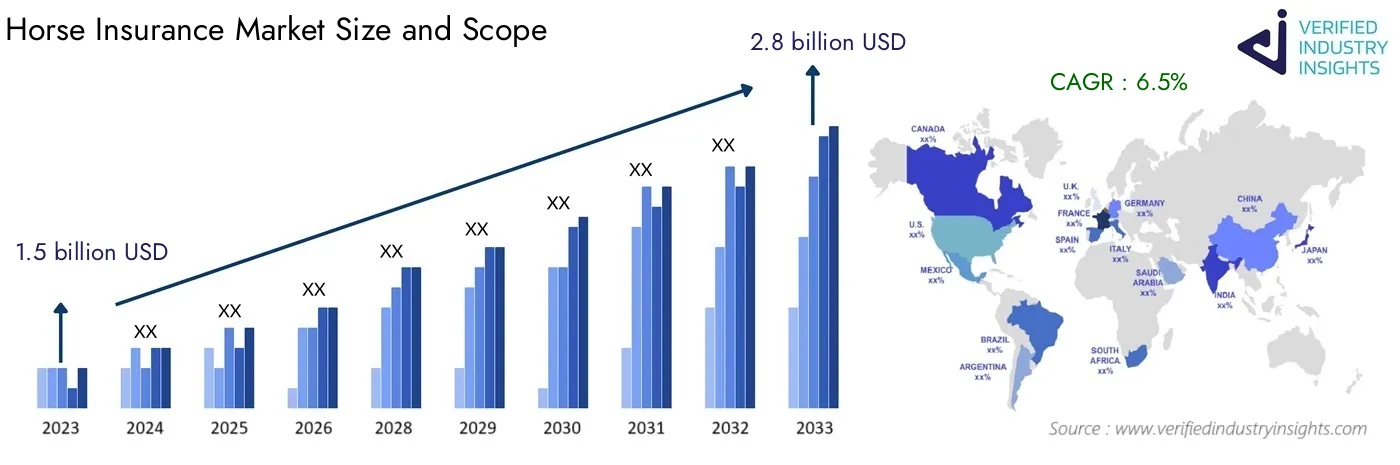

The market size of Horse Insurance Market, valued at 1.5 billion USD in 2023, is projected to reach 2.8 billion USD by 2033, expanding at a CAGR of 6.5% between 2024 and 2033. The report comprises various segments and analyzes significant trends and factors influencing market growth.

The horse insurance segment is now emerging as a noteworthy market within the insurance industry, motivated by the growing appreciation of equines’ health and welfare. Furthermore, as horse ownership and interest in equestrian activities continues to grow across the world, the requirement for more sophisticated insurance policies catering to different types of risks has escalated. Horse insurance provides vet fee cover, theft and liability protection, and other policies which foster assurance among horse owners whilst promoting responsible stewardship of these assets.

The industry has recently experienced some innovation in terms of product design and dimensions of policies aiming to serve various categories of horse owners. This growth is fueled by advancements in veterinary care and increasing awareness of the financial implications linked with horse ownership. Also, an upsurge in competitive equestrian activities and leisure riding created a distinct need for additional specialized insurance, prompting insurers to adapt their services to tackle the unique demands of horse owners. While analyzing the realities of the horse insurance market, we will discussUnderlying the most important market trends, drivers and challenges for this crucial industry.

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2023-2033 |

| BASE YEAR | 2023 |

| FORECAST PERIOD | 2024-2033 |

| HISTORICAL PERIOD | 2023-2024 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | Nationwide Mutual Insurance Company, The Hartford, Markel Corporation, Chubb Limited, Travelers Insurance, American Equine Insurance Group, Protective Insurance, Great American Insurance Group, AIG (American International Group), Farmers Insurance Group, Equine Insurance Services |

| SEGMENTS COVERED |

By Type of Coverage - Accident Insurance, Major Medical Insurance, Mortality Insurance, Liability Insurance, Surgical Insurance

By Policy Type - Individual Policies, Group Policies, Farm and Ranch Policies, Commercial Policies, Special Event Policies

By End User - Private Horse Owners, Professional Equestrians, Riding Schools, Breeders, Veterinary Clinics

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World. |

Horse Insurance Market Dynamics

The Horse Insurance Market is undergoing significant changes due to various dynamic factors. This section delves into the key drivers, restraints, opportunities, and challenges that are shaping the market landscape.

Market Drivers

- Technological Advancements

- Increasing Consumer Demand

- Regulatory Support

- Globalization

Market Restraints

- High Operational Costs

- Regulatory Challenges

- Market Saturation

Market Opportunities

- Emerging Markets

- Product Innovation

- Strategic Partnerships

Market Challenges

- Technological Disruptions

- Supply Chain Issues

- Changing Consumer Preferences

Horse Insurance Market Segmentations

Market Breakup by Type of Coverage

- Overview

- Accident Insurance

- Major Medical Insurance

- Mortality Insurance

- Liability Insurance

- Surgical Insurance

Market Breakup by Policy Type

- Overview

- Individual Policies

- Group Policies

- Farm and Ranch Policies

- Commercial Policies

- Special Event Policies

Market Breakup by End User

- Overview

- Private Horse Owners

- Professional Equestrians

- Riding Schools

- Breeders

- Veterinary Clinics

Market Breakup by Region

North America

- United States of America

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Players in the Horse Insurance Market

This report provides an in-depth analysis of both established and rising industry participants. It provides broad lists of important companies organized by the types of products they offer and other market-related factors. In addition to characterizing these companies, the report contains the year each player entered the market, which is useful for research analysis by the study's analysts.

- Nationwide Mutual Insurance Company

- The Hartford

- Markel Corporation

- Chubb Limited

- Travelers Insurance

- American Equine Insurance Group

- Protective Insurance

- Great American Insurance Group

- AIG (American International Group)

- Farmers Insurance Group

- Equine Insurance Services

Customization Options

Verified Industry Insights offers one of the following report customization options to our respectable clients :

Company Profiling

● Detailed profiling of additional market players (up to three players)

● SWOT analysis of key players (up to three players)

Competitive Benchmarking

● Benchmarking of key players on the following parameters : Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research

Verified Industry Insights offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected] or call us at +1 743 222 5439

© 2024 Verified Industry Insights. All Rights Reserved